Vietnam: A Major Winner in the US-China Trade War

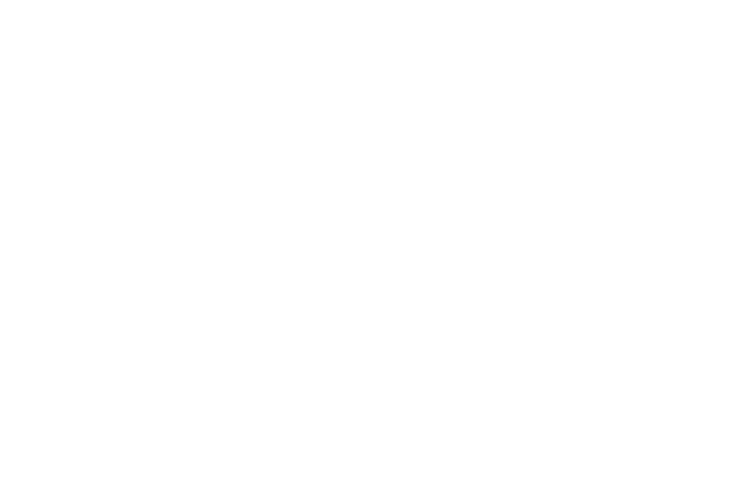

During Donald Trump’s first term, Vietnam emerged as a top beneficiary of the US-China trade war. Many companies moved production from China to Vietnam to avoid tariffs. This helped Vietnam build the fourth-largest trade surplus with the US, after China, Mexico, and the European Union.

However, trade experts warn that Vietnam could face serious risks if Trump returns to the White House and reintroduces broad trade tariffs.

The “China Plus One” Strategy Brings Success but Also Risks

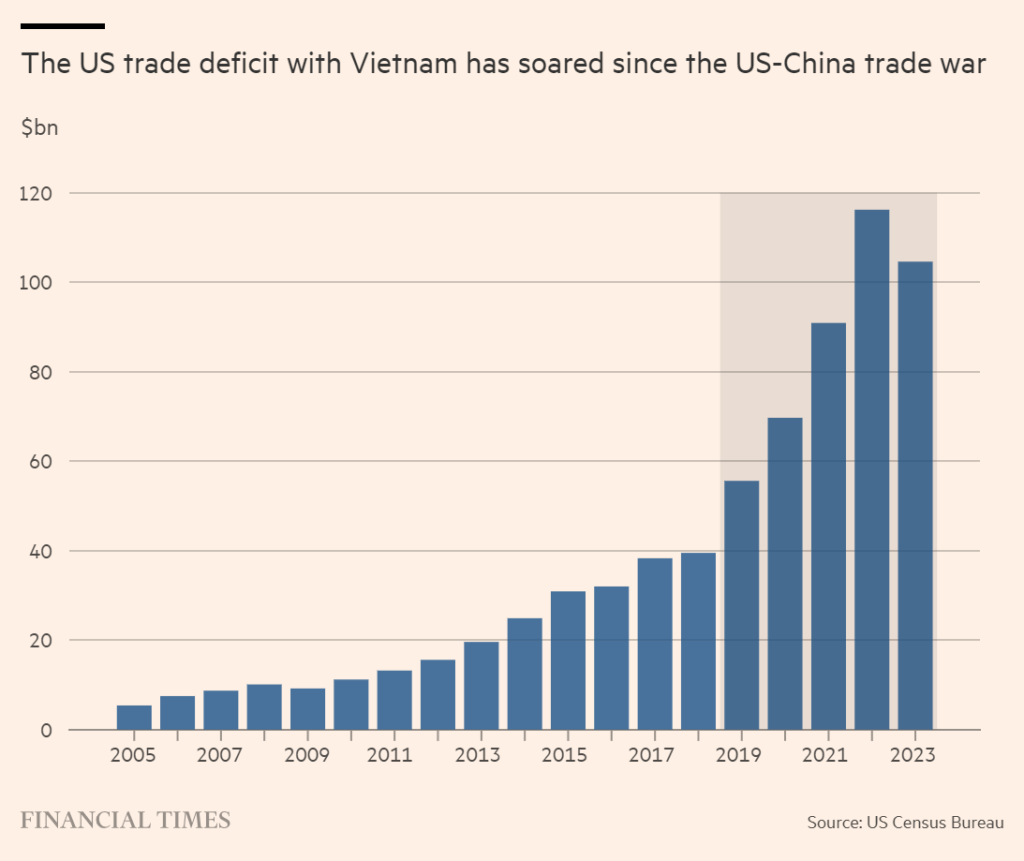

Vietnam’s “China plus one” manufacturing strategy has been successful. But it has made Vietnam’s economy more dependent on the US, which now accounts for nearly 30% of its exports.

Marco Förster, ASEAN Director at Dezan Shira & Associates, says Vietnam may face closer scrutiny—especially for goods routed through Vietnam to avoid tariffs on Chinese products.

Trump has proposed a 60% tariff on Chinese imports and up to 20% on goods from other countries. Economists at OCBC Bank warn that these tariffs could reduce Vietnam’s GDP growth by up to 4 percentage points from last year’s 5%.

“If tariffs target Vietnam, the economic impact could be catastrophic,” Förster warns.

Trump’s Past Comments Raise Concerns Among Investors

Although Trump did not mention Vietnam in his recent campaign, he called Vietnam “almost the single worst abuser of everybody” in 2019. He said Vietnam “takes advantage of us even worse than China.”

These statements have unsettled foreign investors.

Hong Sun, Chairman of the Korea Chamber of Business in Vietnam, said some Korean firms worry about possible tariffs under a new Trump administration. South Korea is one of Vietnam’s largest foreign investors, with Samsung as the top investor. If the US imposes tariffs, South Korean companies may cut back investments and production.

Vietnam’s Leadership Warns Against Trade Wars

At the recent APEC summit in Peru, Vietnam’s President Luong Cuong said, “Isolationism, protectionist policies, and trade wars only lead to economic recession, conflict, and poverty.”

He stressed the need to move beyond a “zero-sum game” mindset and avoid nationalism distorting trade policies.

Vietnam Leads Southeast Asia in Attracting Foreign Investment

Southeast Asia benefited from the US-China trade war, but Vietnam stood out as the biggest winner. Its proximity to China, pro-business policies, and government incentives helped it become a manufacturing hub.

In 2024, Vietnam’s foreign direct investment (FDI) reached $36.6 billion, and its trade surplus with the US jumped to over $104 billion—almost three times the $38 billion in 2017.

Thailand was second with a $41 billion US trade surplus.

US-Vietnam Relations Strengthen Under Biden

Since Trump left office, US-Vietnam ties have improved significantly. In 2023, the countries upgraded relations to a “comprehensive strategic partnership,” Vietnam’s highest diplomatic status.

President Biden called Vietnam “a critical power in the world and a bellwether in this vital region.” He also removed the “currency manipulator” label imposed by the Trump administration.

The US supports Vietnam’s semiconductor industry to reduce China’s access to advanced chips. Experts say Vietnam might ease US concerns by tightening scrutiny of Chinese investments, launching anti-dumping probes, or increasing imports of US goods like LNG, aircraft, or defense equipment.

Economic Limits and Trade Challenges

Vietnam’s relatively small economy limits how much it can boost imports from the US. Peter Mumford, Southeast Asia Director at Eurasia Group, said Vietnam might increase investment in the US, but this won’t solve Washington’s trade deficit concerns.

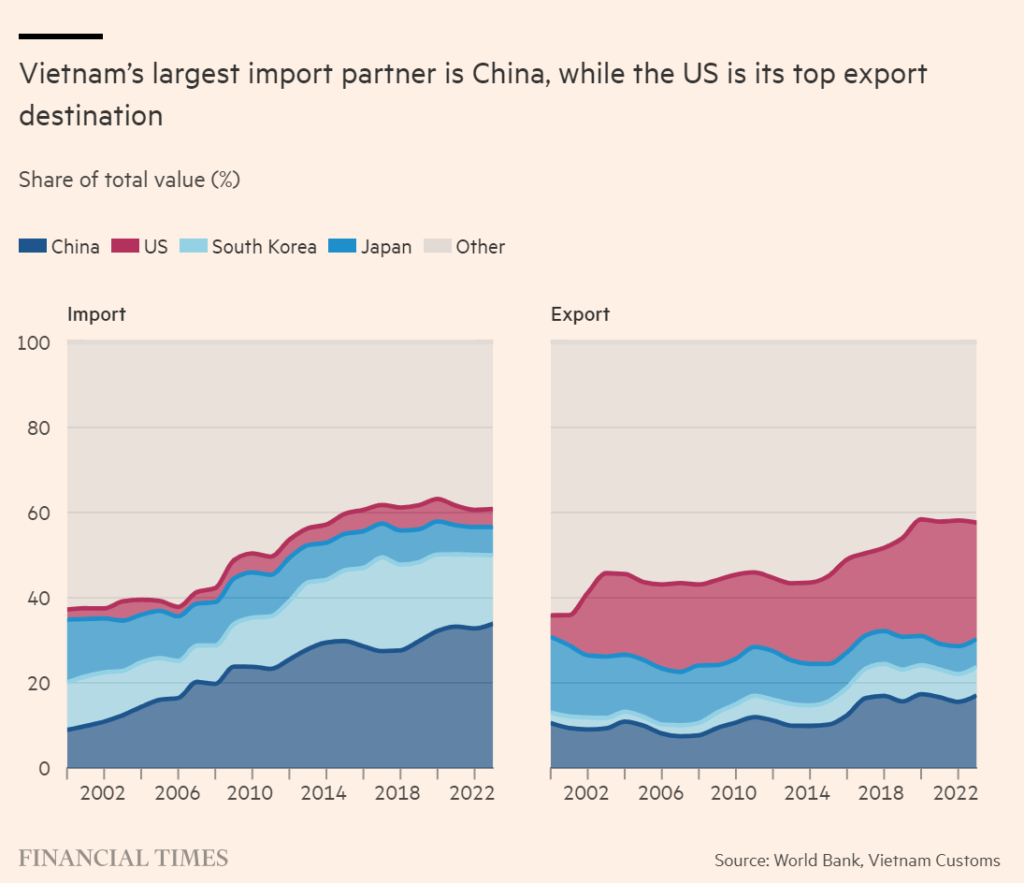

China’s Investment in Vietnam Soars

China’s FDI in Vietnam surged nearly 80% in 2023, showing deepening ties.

Vietnam follows a “bamboo diplomacy” policy, balancing relations with both the US and China. But raising imports from the US could upset China, Vietnam’s biggest trading partner and neighbor.

In 2023, China led in new investment projects in Vietnam. Marco Förster noted many Chinese goods are routed through Vietnam to avoid US tariffs, sometimes with fake “Made in Vietnam” labels.

Vietnam Tightens Rules to Avoid Trade Risks

Vietnam is working to enforce stricter labeling rules and rules of origin to reduce trade tariffs risks.

Thuy Anh Nguyen, director at Dragon Capital, said Vietnam will likely increase scrutiny of Chinese investments but will remain attractive for FDI as production shifts from China.

Vietnam plans to adjust trade practices, negotiate more trade agreements, and boost compliance to minimize trade tariffs risks.